By The Landlord

“What we need is a tax on human stupidity.” – Marty Rubin

“In this world nothing can be said to be certain, except death and taxes.” – Benjamin Franklin

“He's spending a year dead for tax reasons.” – Douglas Adams, The Hitchhiker's Guide to the Galaxy

“He said that there was death and taxes, and taxes was worse, because at least death didn’t happen to you every year.” – Terry Pratchett, Reaper Man

“I don’t avoid tax, I evade it. Or is it the other way around? Shut up!” - Alan Partridge (Steve Coogan)

“Income tax returns are the most imaginative fiction being written today.” – Herman Wouk

“I hate paying taxes. But I love the civilisation they give me.” – Oliver Wendell Holmes

“You can’t tax business. Business doesn’t pay taxes. It collects taxes.” – Ronald Reagan

"We don't pay taxes. Only the little people pay taxes." – Leona Helmsley, American hotel tycoon and 'Queen of Mean’

"I told the Inland Revenue I didn’t owe them a penny because I lived near the seaside.” – Ken Dodd

As I was walking down the street yesterday I walked past a man begging. I felt sorry for him, and wanted to help, but I had no cash on me. So I went straight to the cash point, and withdrew 10 pounds. Then before doing anything else, I put the money in a plain, brown envelope. Then I went quickly to the nearest wealthy area street, found a huge house, and put the money through the letter box. I felt that this was the best way for him to benefit through trickle-down economics.

Such are the kind of bleakly humorous gags going around at the moment in the wake the recent British Tory government mini-budget created by Chancellor Kwasi Kwarteng under the orders of new Prime Minister Liz Truss, one that most prominently included the removal of the top rate of income tax, with a reverse-Robin Hood effect to favour the wealthy party-member minority that elected her, resulting in massive borrowing, increased inflation, the crash of the pound, and, with so many other problems at large, the potential collapse of the British economy. In other words, an act of unbelievable blind, obstinacy, greed and stupidity. So with that in mind, this week it seems apt to get our own finances in order by straightening out our own fiscal response with a pennywise playlist.

It need not be a grey spreadsheet, instead, hopefully columns filled with a colourful cast of characters, styles, and stories adding up to a wealthy total of great music.

Money itself is an enormous lyrical topic, one previously poured over, but not for a long time and not yet here at Song Bar. But to focus it a little more, without getting pulled into vast, dry, economic theory, this week let’s turn our attention to the facts and emotions surrounding the payment, avoidance, uses, rights and wrongs of taxation and in general the effect and the distribution of wealth, or indeed lack thereof.

We live in odd times. It’s likely that many songs will be chiefly in the ‘taxes are bad’ category, but at the moment, and least in the UK, the stink of injustice and inequality is seems more in the air then ever, and that paying taxes, especially by the corporations and the wealthy, and moreover the correct use of these funds, might be the only way out of the ongoing mess we’re in.

Taxation is a powerful idea, a pivot point for social justice and just as much injustice. It’s often one that many feel should be vigorously applied, though not to themselves.

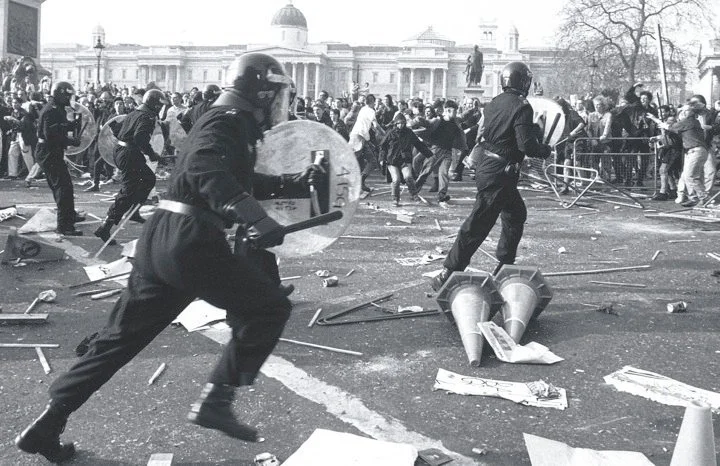

It has kept economies afloat, but also caused them to sink. It has caused rebellions and wars, and brought down leaders, and even countries. It comes in many forms, from sales to income, property to inheritance, but is rarely balanced. In the UK, and in colonial America, for example, it has been levied on windows (beginning in 1707), which is why on older buildings you might see so many bricked up, and tax on various items such as sugar, cloth, and coffee, and the Boston Tea Party uprising by American colonists was retaliation for the Tea Act, which gave British East India Company’s exemption from taxes. Right-wing American extremists now adopt the Tea Party name as a movement. But on the other end of the political spectrum, campaigns for equality and a sense of injustice led to The Poll Tax Riots in London in 1990, which helped bring the downfall of Margaret Thatcher. Taxing times in different times and in many different ways.

Boston Tea Party, 1773

Different taxing times: Poll Tax Riot in Trafalgar Square, London 1990

There have always been many forms of taxes and tariffs, but income tax in the UK was first introduced by William Pitt The Young in 1799 to pay for the Napoleonic Wars. Since then it has been variously, reviled and fiddled with by various leaders, from his successor Henry Addington to later prime ministers Benjamin Disraeli and William Gladstone, all of whom have announced its dissolution but have variously reintroduced it. Income tax has been a hot potato ever since.

During the Second World War, the top rate of income tax peaked at 99.25%, and regularly reached up to 90% after that even into the 1950s and 60s. So when The Beatles wrote a certain song (previously chosen for the topic of fractions) ironically detailing the proportion of “there’s one for you, nineteen for me” it was roughly accurate, but only for the top tier of earnings.

Higher income taxes, especially for the wealthiest, also continued in the US into the 1970s, and arguably brought about a general rise in living standards for the majority. “All told, over the period 1932-1980, nearly half a century, the top federal income tax rate in the United States averaged 81 percent, writes Thomas Piketty, in his acclaimed Capital in the Twenty-First Century.

Reagan and Thatcher: Taxes? Ha ha, not for the rich!

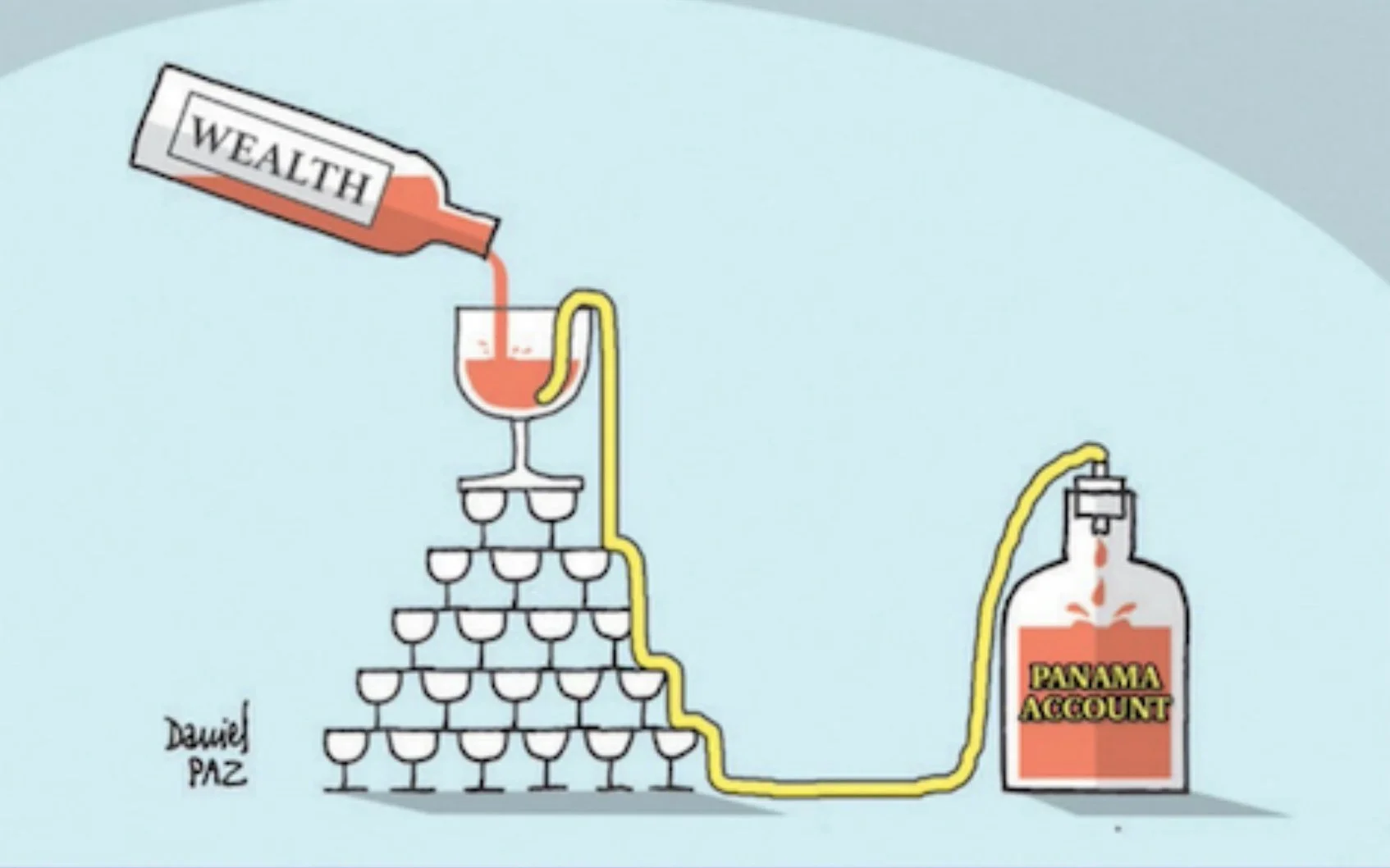

However, all that changed with the advent of Reagan and Thatcher in the 1980s when income tax dropped dramatically and free market economics took over. That, in the latest version of the disastrous British Tory government is taking that theory to ever more absurd levels, as poverty gaps continue to widen, and Reagan’s remark above is taken to ever more brazen levels and vast companies, manage to pay little or no tax through avoidance schemes such as using countries such as Panama for their registration.

Here’s Thomas Piketty again, this time from his book Capital and Ideology: “Billionaires think that anything goes, are enamoured of geoengineering, and detest nothing so much as simple but unpleasant solutions (such as paying taxes and living quietly).”

And here’s Noam Chomsky from Imperial Ambitions: Conversations on the Post-9/11 World: “Corporations barely pay taxes. The corporate tax rate is already very low, but corporations have worked out an array of complicated techniques so they often don't have to pay taxes at all... The scale of sheer robbery by corporate power is enormous.”

And here’s Nicholas D. Kristof, from Tightrope: Americans Reaching for Hope, highlighting the injustice and imbalance of the American system: “The wealthy have also fought to underfund and defang the Internal Revenue Service, so it doesn’t have the resources to audit or fight dubious deductions. Only about 6 percent of tax returns of those with income of more than $1 million are audited, along with 0.7 percent of business tax returns. Meanwhile, there is one group that the IRS scrutinises rigorously: the working poor with incomes below $20,000 a year who receive the Earned Income Tax Credit. More than one-third of all tax audits are focused on that group struggling to make ends meet, even as the agency cuts back on audits of the wealthy—while the top 5 percent of taxpayers account for more than half of all underreported income.”

Ruthless American hotel entrepreneur Leona Helmsley is mild by comparison to today’s major tax avoiders. Although she’s wasn’t famously known as the ‘Queen of Mean’ for nothing. She cut two grandchildren out of her will, but left $12 million to her dog, a Maltese named Trouble.

It’s no dog’s life: tax avoiding billionaire Leona Helmsley

But whether it is Donald Trump or any other high-profile figure, why is it the wealthiest do their best to avoid tax? Perhaps it is something in childhood, or something in the sociopath profile that refuses to grow up and face responsibility. “The invention of the teenager was a mistake. Once you identify a period of life in which people get to stay out late but don't have to pay taxes - naturally, no one wants to live any other way,” says the American writer Judith Martin.

Alan Partridge, played by Steve Coogan, could never get it the right way round, but while evasion is illegal, avoidance is technically legal. And is not just the corporations who seek it, but many figures in showbusiness and music. “I’ve made a terrible error of judgement,” admitted the creepy comedian Jimmy Carr, who in 2012 was found to have been using an offshore ‘wealth management’ Panama-style scheme, sheltering £3.3 million and only paid 1% tax using the K2 setup, which channelled the salaries of beneficiaries in the UK through Jersey-based shell corporations. No sanctions, just shame.

It seems to be a universal practice from the top down. Tory PM David Cameron referred at the time to such practises as “morally wrong”, but, surprise surprise, several years later it was revealed that he had directly benefited from his father’s involvement in similar dubiously legal schemes.

There are other ways to get away with it too. In 1989 it came to light that the Liverpool comedian Ken Dodd had evaded a huge amount of tax, but got off with an acquittal, in part due to his court performance and the skill of his lawyer, George Carman QC, who said: "Some accountants are comedians, but comedians are never accountants”, and described Dodd as "a fantasist stamped with lifelong eccentricities.”

When asked by the judge, “What does a hundred thousand pounds in a suitcase feel like?”, Dodd made his now famous reply, “The notes are very light, M’Lord.”

Ken Dodd: making light of the case …

But not everyone gets away with tax dodges when it goes, technically into the evasion category, and many of these have been musicians. Chuck Berry was diddled in the early part of his career by bad record deals that robbed him, but later sought to catch up with as much cash as he could, and served four months in jail for income tax evasion in 1979.

But many managed to avoid jail despite questionable practices in that blurred line between avoidance and evasion. Gary Barlow of Take That was found to have been using aggressive tax avoidance schemes in 2014, but due to other investments, reportedly he and bandmates rHoward Donald and Mark Owen and band manager Jonathan Wild, were ordered by HMRC repay £20 million in June 2016.

Willie Nelson, Toni Braxton, Prince, Whitney Houston, Ja Rule, Marc Anthony are among others have all fallen foul of the system and have had to dig themselves out of massive fine holes. Judy Garland’s home was foreclosed by the IRS and she spent years traveling from hotel to hotel before dying of an accidental drug overdose in 1969.

Al Capone. Got away with murder, but not tax evasion …

Garland was a delicate, troubled and unstable character. Yet even the toughest cookies can get caught by the tax system. Al Capone got away with murder, literally, but it was tax evasion that got him an 11-year jail term. He only served seven and a half, and was 40 years old at the time of his release, but by then his brain was riddled with syphilis, so you could say he was totally fucked.

Many musicians live on breadcrumbs, and are short-changed by record companies and managers in the early part of their career. Perhaps that is why songs are directed negatively towards the tax system. But when managed ruthlessly, playing music can sometimes also go hand in hand with playing the system. The Rolling Stones are not alone in high profile British musicians who have become tax exiles. In 1972 their arguably greatest album Exile on Main St. was recorded in France, where they had relocated in order to avoid paying huge tax bills in England.

But according to Rolling Stone Magazine, by coincidence, the band have, legally set up private foundations in Holland, where they have reportedly banked since the 1970s. And for according to this publication, laws about public access to information apparently revealed that of the £242 million the Stones had made in royalties since 1986, they'd paid only £3.9 million in taxes at a rate of just 1.6 percent. Gimme Shelter, then, from paying much tax.

Exiles Mick and Keith back in ‘72: Gimme shelter from tax bills?

It’s a hot topic at the moment, so unsurprisingly the Bar is jammed with others keen to have their say on this divisive issue.

Albert Einstein is at his usual table, and sets the debate further with his own brand of humour. When faced with filling in his own tax return, he says: “This is a question too difficult for a mathematician. It should be asked of a philosopher.”

Tax discussions seem to be bringing people together rather than avoiding. “Every culture has some ritual for joining two people together and making them stay that way, and ours is giving tax breaks,” remarks the writer Bauvard with a smirk, quoting from Some Inspiration for the Overenthusiastic.

The American financial analyst turned writer Sean Kernan brings up another way of looking at tax, not only on the poor, and gambling, but also on time. “They say the lottery is a tax on people who can’t do the math. I would say arguing on the internet is a tax on people who don’t value their time.”

There are some in the Bar who see taxation only in an negative light. “The intelligent man, when he pays taxes, certainly does not believe that he is making a prudent and productive investment of his money; on the contrary, he feels that he is being mulcted in an excessive amount for services that, in the main, are useless to him, and that, in substantial part, are downright inimical to him,” says H.L. Mencken, brandishing his copy of A Mencken Chrestomathy.

The American anarchist, abolitionist and writer Lysander Spooner meanwhile makes this extended metaphor, preferring to be robbed by a common criminal than the government:

“The fact is that the government, like a highwayman, says to a man: Your money, or your life...The government does not, indeed, waylay a man in a lonely place, spring upon him from the road side and, holding a pistol to his head, proceed to rifle his pockets. But the robbery is none the less a robbery on that account; and it is far more dastardly and shameful. The highwayman takes solely upon himself the responsibility, danger, and crime of his own act. He does not pretend that he has any rightful claim to your money, or that he intends to use it for your own benefit. He does not pretend to be anything but a robber...Furthermore, having taken your money, he leaves you as you wish him to do. He does not persist in following you on the road, against your will; assuming to be your rightful 'sovereign,' on account of the 'protection' he affords you.”

A different trickle down economics ..

“There is no art which one government sooner learns of another than that of draining money from the pockets of the people,” says Adam Smith from his An Inquiry into the Nature and Causes of the Wealth of Nations, and yet also he says that taxation is necessary:

“Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism but peace, easy taxes, and a tolerable administration of justice”.

Another heavyweight, Thomas Paine, lands with this from his topical book, The Crisis: “When a man pays a tax, he knows that the public necessity requires it, and therefore feels a pride in discharging his duty; but a fine seems an atonement for neglect of duty, and of consequence is paid with discredit, and frequently levied with severity.”

And yet there are others who define the necessity of taxes, despite their burden.

“What is taxation? Taxation is what you pay to live in a civilised society- what you pay to have democracy and opportunity,” says George Lakoff, flogging his book Don't Think of an Elephant! Know Your Values and Frame the Debate: The Essential Guide for Progressives.

Vanessa Williamson meanwhile goes even further with an idealised perspective. From Read My Lips: Why Americans Are Proud to Pay Taxes, she reckons: “The idea that ‘Americans hate taxes’ has become a truism without the benefit of being true. Instead, Americans see paying taxes as a civic obligation and a political act. To be a taxpayer, Americans believe, is something to be proud of. It is evidence that one is a responsible, contributing, and upstanding member of society, a person worthy of respect in the community and representation in the government.”

So then, it’s time to add our own contributions, if not financial then certainly musical. Inspector of tonal taxation this week, I’m delighted to announce is comes with the brilliant balance sheet of the sagacious Severin! Place your songs in comments below in time for the deadline on Monday at 11pm UK for playlists published next week. Tax and spend your time wisely and generously.

New to comment? It is quick and easy. You just need to login to Disqus once. All is explained in About/FAQs ...

Fancy a turn behind the pumps at The Song Bar? Care to choose a playlist from songs nominated and write something about it? Then feel free to contact The Song Bar here, or try the usual email address. Also please follow us social media: Song Bar Twitter, Song Bar Facebook. Song Bar YouTube, and Song Bar Instagram. Please subscribe, follow and share.

Song Bar is non-profit and is simply about sharing great music. We don’t do clickbait or advertisements. Please make any donation to help keep the Bar running: